The moratorium on evictions, which was created by the CDC during the height of the pandemic outbreak, has ended in part due to a Supreme Court ruling saying the CDC has no authority doing this and because Congress could not pass an emergency measure extending the moratorium.

There are over 5.7 million Americans behind on their rent and over $20 billion in rent is past due. What is concerning to many is that despite all these federal payouts in the trillions nothing was provided to assuage the problem, as in the $20 billion in unpaid rent which caused real financial problems for landlords.

Why were there no provisions to assist small landlords who could not afford to weather losing so much income in order to keep the real estate market more stable? The answer is that the ruling class are positively hostile to anyone save the very rich owning real estate in this country, their goal being the end of private ownership outside of government and mega corporate entities they, the ruling class, control.

Landlords, many of whom are middle class owners of one or a few properties, have been unprotected and losing money while renters have been unable to make ends meet due to the government mandated lockdowns of the entire population. The balance between the landlords who went without income and the renters who lost income had never been struck.

The moratorium didn’t end the running up of a tab, renters who didn’t pay anything still owe full rent for all those months. In some cases, renters have actually abused the property and took advantage of the situation and could not be evicted even in those cases.

But many landlords are also major owners of multiple properties and renting homes to the massss has become an industry of its own, often offering poorer quality residences for increasingly high costs to maximize profits. These speculative landlords drive up prices for housing, making it more difficult for the lower income among us, which, ironically, means the same house or apartment they overpay to rent cannot be bought even if they have been renting it for years.

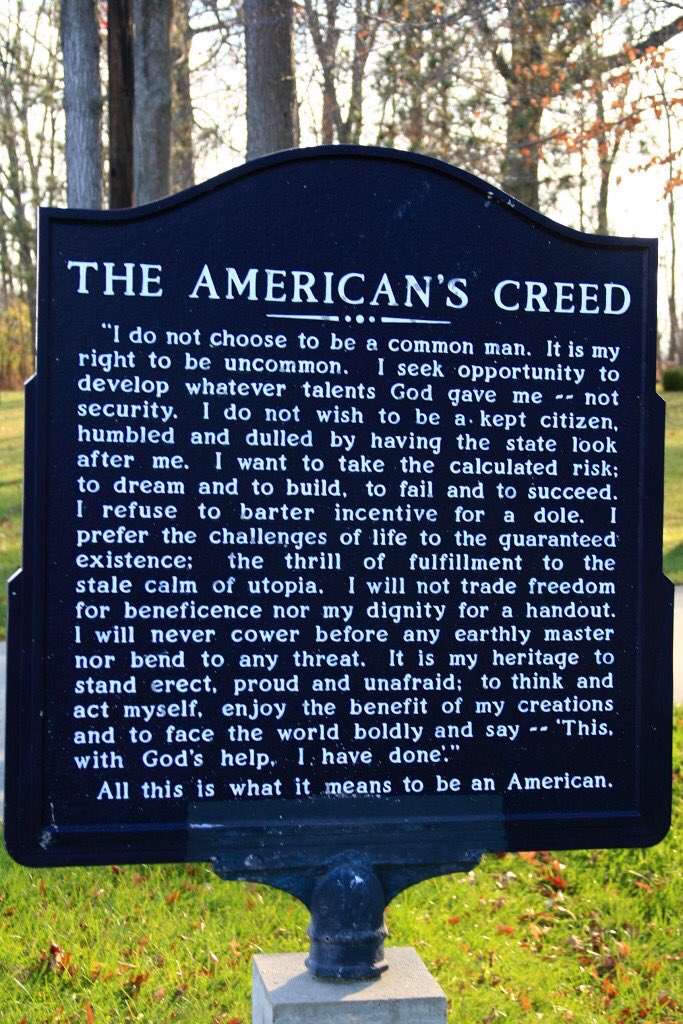

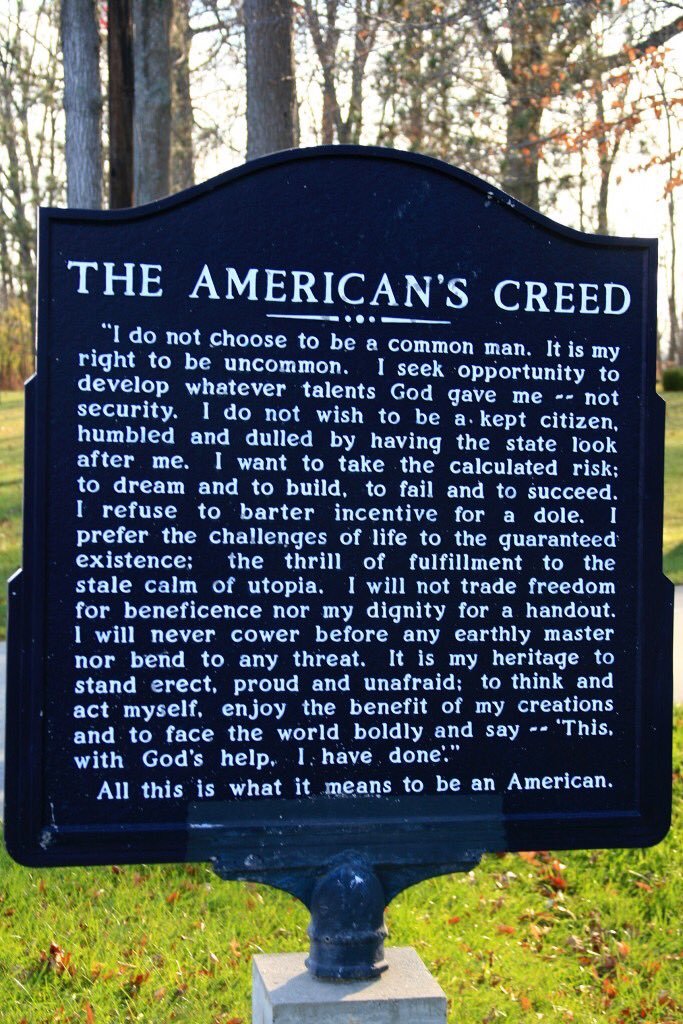

Home ownership is an essential elment in achieving total material independency but too many obstacles to home ownership, including how we do credit checks, taxes, and real estate speculation are making home ownership impossible for poorer people and the young.

Sympathy for the landlords is just not there because most people see a typically wealthy owner of multiple properties who overcharges renters and speculatively buys multiple properties, driving up prices which hurts the very people forced to rent from them. But many other landlords are not rich people or speculative real estate buyers, they are average people who may rent out a room or a guest house or property they inherited.

The collision now between landlords of every type and renters who have either been unable or unwilling to pay is real and the potential for a new housing crisis, not to mention a rush on the courts, is substantial. Could the smaller landlords be forced out of their business only to see mega corporate landlords take over more property and continue a trend away from individual ownership to corporate ownership of real estate?

The “great reset” claims “you will own nothing and like it”, and the disorganized way this moratorium is ending may contribute even more to the transfer of wealth and ownership from the many to the few. This does not bode well for the cause of promoting individual material independency as a means of increasing freedom for all.

Legally, this moratorium was unfounded and many renters did in fact receive substantial federal money allegedly to sustain themselves, so at least some payment to these landlords could have been made. But the entire issue points to the core problem that property ownership itself is in jeopardy and the rules, laws, and regulations as well as taxes surrounding property ownership are more conducive to the concentration of ownership in few hands than the material independency of individuals.